US business owners are increasingly concerned about the impact of severe weather on their people, property and day-to-day operations. This concern is reflected in this year's Gallagher Business Owners survey, which found that natural disasters were a top concern for 91% of business owners. The survey also sheds light on the growing worry among business owners that they may not have adequate cover to pay for future losses.

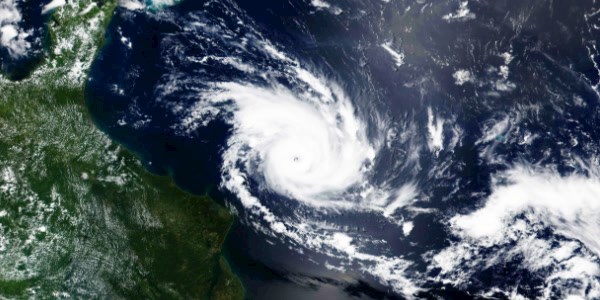

It's not difficult to see why extreme weather is top of mind as the US continues to see widespread catastrophic events such as convective storms, hurricanes that cause damage and flooding, and wildfires. When these events are combined with urban sprawl and increased costs to construction labor and materials, the cost of disasters across the US is resulting in a more challenging insurance market. For the 84% of respondents who said they had made a business-related claimed on their insurance in the past year, the realities of dealing with property damage, safeguarding staff and navigating periods of business interruption are feeling ever present.

Severe convective storms have become a major driver of loss

During the first half of the year, total claims from natural peril events around the world were USD61 billion, with US severe convective storms (SCS) driving 61% of the loss (USD37 billion), according to Gallagher Re. Moreover, insured losses for SCS topped USD100 billion over the last 18 months, making it the costliest period on record.

And with hurricane season well underway, with forecasts for above-average storm activity, there's heightened potential for greater loss during the second half of the year.1

Historically, the insurance industry's average annual losses from natural catastrophes were driven by the "peak perils," such as windstorms, with reinsurance absorbing a sizable segment of the claims. But it's increasingly the case that secondary perils make up the bulk of the industry's total claims, with implications for carriers and commercial insurance buyers.

It means that a growing number of businesses, over a wider geographical area, are generally more exposed to weather losses now than in the past, making it harder for carriers to model and predict losses.

Carriers reassess their appetite for catastrophe risk

The cost of coverage is rising, and mid-market firms are seeing some of the highest increases. "Traditional catastrophe losses were viewed as hurricane and earthquake, so the likes of Florida and California have been addressing this for years. But now secondary-peril-driven catastrophes are impacting our clients in the Midwest, New Mexico, Colorado and Illinois," observes Martha Bane, leader of Gallagher's Property practice.

Insurance carriers are responding to the rising quantum of property damage claims by withdrawing capacity, particularly in catastrophe-prone states, increasing the cost of coverage and continuing to tighten policy terms. As a result, the cost and availability of coverage remain a pinch point for many clients, who are taking on substantial risk.