Author: Charlie Cornes

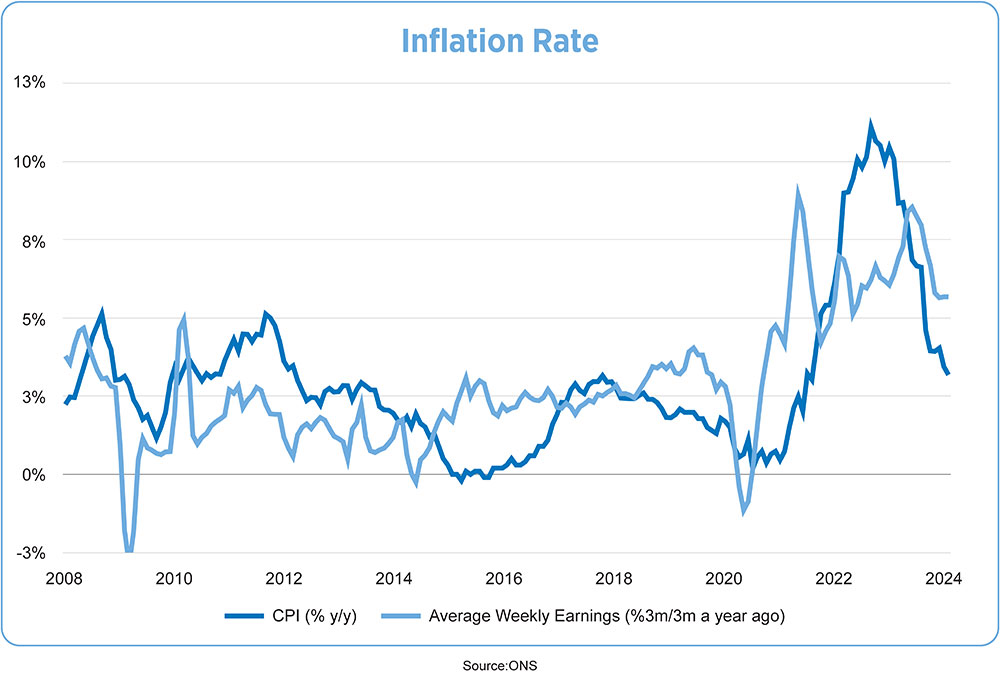

Despite real wages having grown for around six months, consumers are still gradually shaking off the effects of the cost-of-living crisis. Inflation has fallen, but prices haven’t, while mortgage rates and rents have soared. The situation is improving but will do so gradually, which is reflected in the forecast for faster but still relatively weak growth this year.

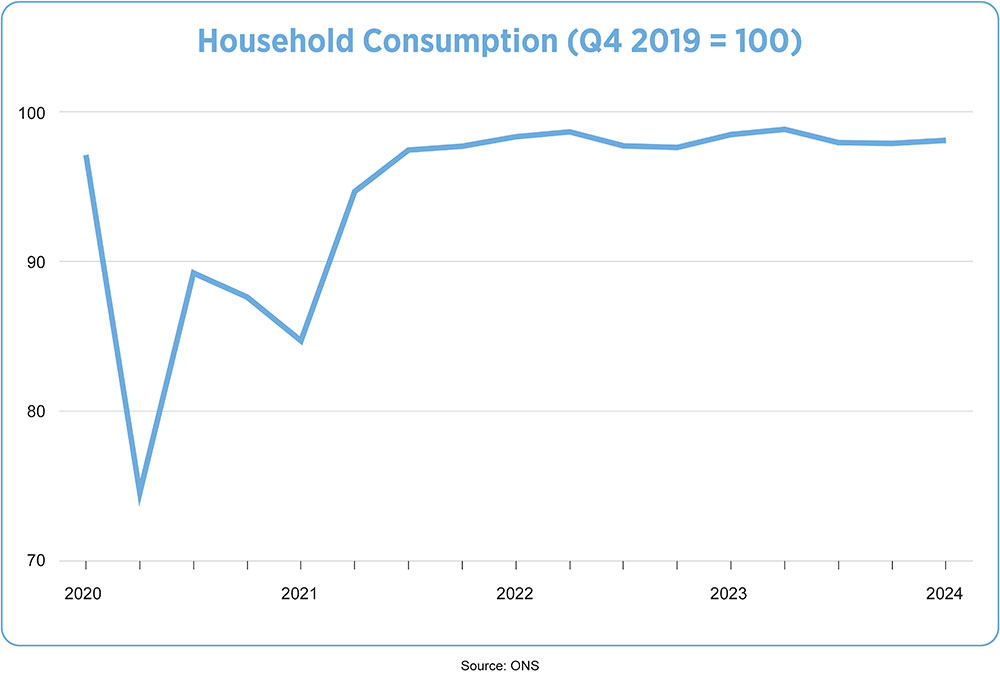

The UK economy grew by 0.6% in Q1 2024, ending a recession experienced in the latter half of 2023. While that seems like a strong growth rate, it was largely driven by a fall in imports and other relatively volatile aspects of trade. Consumer spending continues to linger below pre-pandemic levels having picked up by only 0.2%.

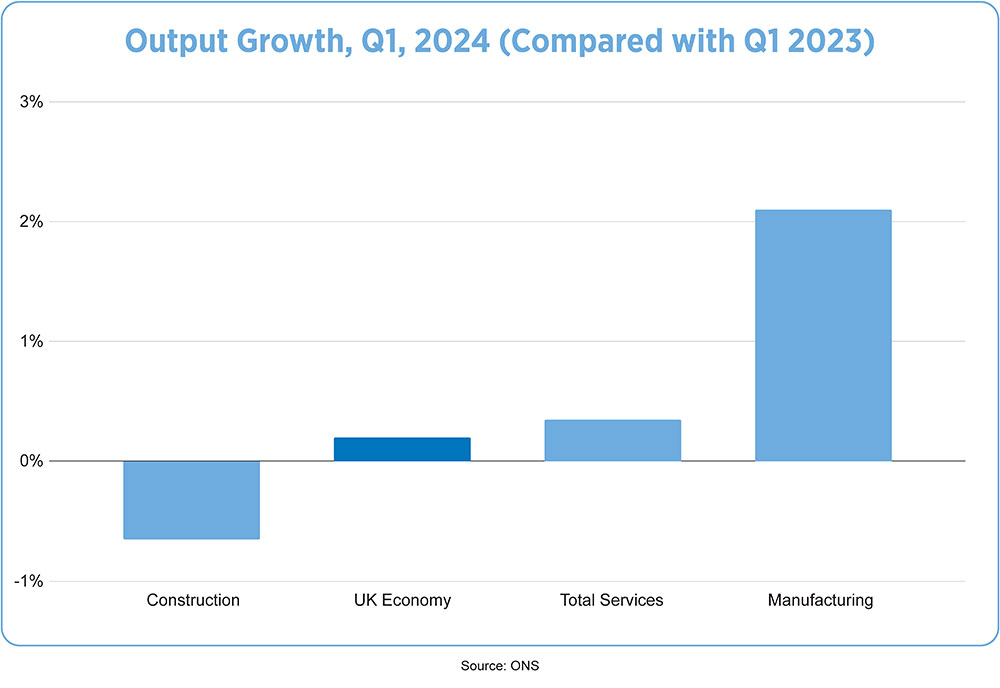

Since Q1 2023, the economy has only grown by 0.2%. Within this, construction output fell in part due to unseasonably wet weather during Q1. Manufacturing picked up by 2.1%, driven by strong growth in cars and transport equipment manufacturing. Similarly, motor trades and transport drove service growth at this time, with more mixed results in other service industries.

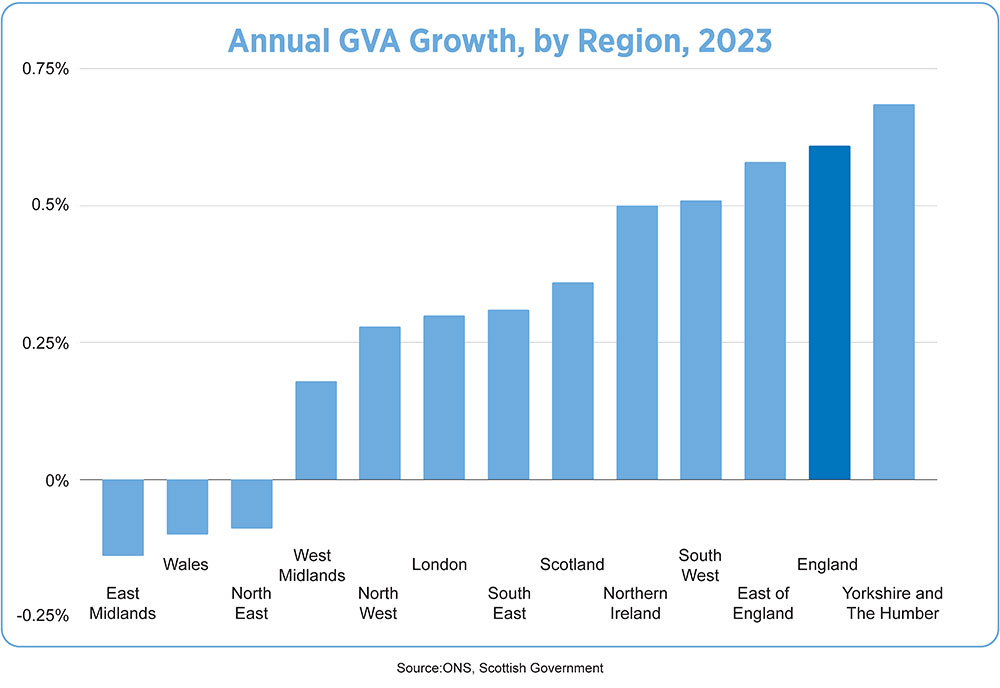

At the regional level, Yorkshire and the Humber has been the strongest performer. We estimate that the northern district's gross value added (GVA) grew by 0.7% in 2023, nearly double that of the UK average. The region is set up to flourish in the coming years due to schemes like the West Yorkshire Investment Zone and Humber Freeport, building on pre-existing strengths of the region such as manufacturing and decarbonisation-related industries. The Freeport alone, is expected to create an additional 7000 jobs as specialist re-exporting businesses relocate to the Humber.

UK economic outlook

Despite lower inflation, higher cost of living and the Bank of England base rate, which is at its highest since the Global Financial Crisis, continues to hinder the economy. Elevated interest rates will weigh on businesses and those 1.5 million homeowners coming off their fixed-rate mortgages this year. Renters have also seen costs go up by 9.2% in the year to March.

That said, the UK economy should gradually recover in 2024, driven by improvements to household finances, as wage growth has outpaced inflation for several months. This will already have been further helped by the reduction in the Ofgem price cap in April, which has reduced energy prices for the typical household by 12% annually. In the same month, National Insurance contributions were reduced, including for those who are self-employed.

While wage growth has helped the consumer outlook, it remains the key sticking point in the Bank of England’s decision on when to begin a rate-cutting cycle, as it continues to feed into elevated services price inflation. However, this should continue to ease gradually as the labour market cools. Indeed, the ratio of unemployment to vacancies, a key indicator of labour market tightness, is nearly back to pre-pandemic levels.

Despite the cooling labour market, we expect that the UK unemployment rate may be near its peak, while interest rates remain at their highest. A pick-up in activity and cuts to interest rates later in the year will lead unemployment to fall back gradually over subsequent quarters, settling at 4.0% by mid-2025.

Based on the current path for inflation, it is likely that the Bank of England will begin cutting interest rates by August. The loosening cycle will be gradual and will likely end with a higher rate of interest than we were accustomed to in the years before the pandemic.

Beyond the main economic risk, inflation and interest rates remain higher than expected; there is also the uncertainty that comes with a potential new government in the UK and other key economies like the US and rising geopolitical tensions abroad. The Middle Eastern conflict or ongoing tensions with China could easily escalate, leading to higher commodity prices, new tariffs or supply chain disruptions.

Even if any of these risks do not transpire, the outlook for the UK is uninspiring. We expect a return to broadly pre-pandemic growth rates, an improvement in recent years but hardly a cause for celebration. The only real path to higher growth is through higher productivity. This will be the key economic challenge for whoever wins the next election.

Webinar: Green shoots of recovery? An outlook on what’s next for the UK economy

Join Charlie’s colleagues, Christopher Breen, Head of Economic Insight at CEBR who will delve into the factors shaping the future of the UK economy and answering the critical question of whether the UK is indeed on the brink of recovery. Tuesday 9 July, 12 p.m.