Author: Tracy Keep

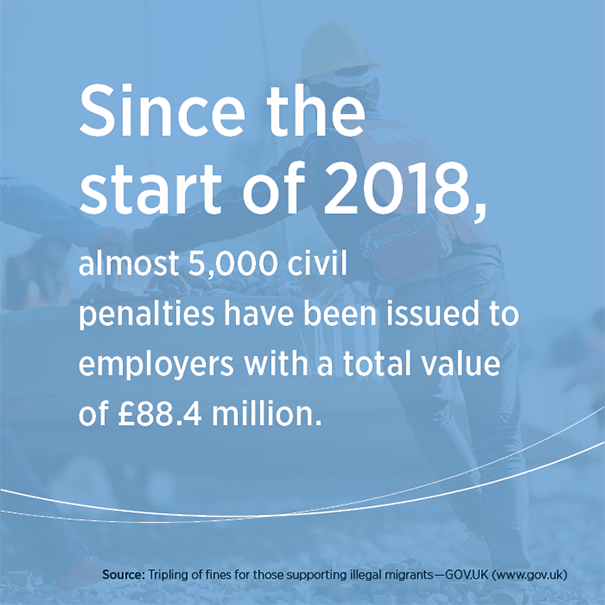

On 7 August 2023, the Home Secretary announced that financial penalties are to be tripled for employers and landlords who allow illegal migrants to work for them or rent their properties, in the biggest shake up of civil penalties since 20141.

The construction sector is particularly vulnerable to the risk of employing illegal workers, with subcontracting and the use of transient self-employed labour common practices.

Hitting construction firms where it hurts

In 2022, the Minister for Immigration, Robert Jenrick, headed a new taskforce to use ‘every available power’ across government to ensure ‘only those eligible can work, receive benefits, or access public services’2.

Plans were put into place to increase immigration enforcement visits in key sectors such as construction, car washes, and gig economy businesses by 50%. Earlier this month, Home Office immigration enforcement officers carried out 159 visits to UK construction sites which resulted in the arrest of 105 foreign nationals working illegally3.

Going a step further with significantly increased fines, the intention is to make hiring migrants illegally ‘financially ruinous’ for businesses—a pretty firm deterrent to construction firms already struggling to protect their balance sheets.

How much are the new fines for hiring illegal workers?

For almost a decade, the fines for employing illegal migrants have remained the same at £15,000 per illegal worker for a first breach to £20,000 for repeat breaches4. Some construction firms have even been factoring these fines into their business models, such is the apparent acceptance of the financial risk.

Under the new fining scheme, the civil penalties for employers will treble to £45,000 per illegal worker for a first breach, and increase to £60,000 for employers that repeatedly offend.

When do the increased fines take effect?

The higher penalties will come in at the start of 2024.

It will remain the case that the worst offenders could face jail sentences of up to five years, closure of their business and disqualification as a director.

Construction firms are under pressure as vacancies remain high

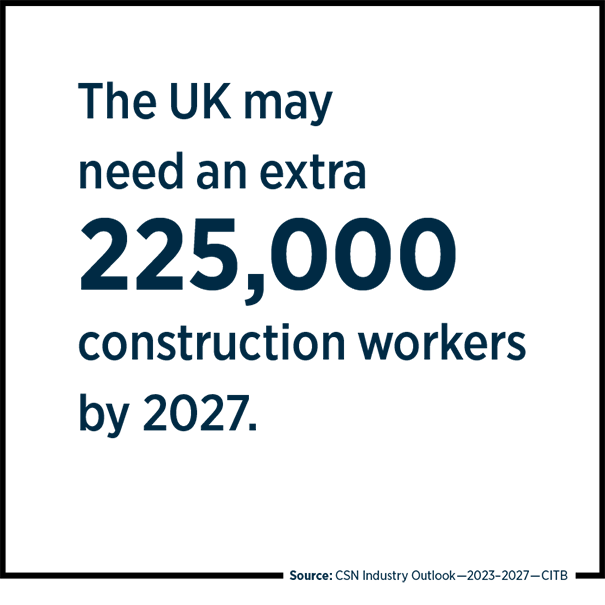

These new fines come at a difficult time for the construction sector, which has still not fully recovered from the impact of Brexit in terms of labour shortages. Before Brexit, around 40% of all construction workers in the UK came from other EU countries5. Construction vacancies at the end of 2022 were still nearly twice as high as pre-pandemic levels6.

The industry still faces a long-term challenge in recruiting workers, with high levels of job vacancies and low levels of unemployment likely to persist6. According to the latest Construction Skills Network (CSN) report, an extra 225,000 construction workers could be needed by 20277, with the major sectors for demand being private housing, infrastructure, and repair and maintenance.

In this competitive labour market, construction firms must place increased focus on hiring workers that have the right to live and work in the UK, and not be tempted to cut corners to fill vacancies.

What if you do not directly employ the workers involved in your business?

Even if you are not the direct employer of people working in your business, it is still important to be sure of their right to work, for numerous reasons:

- If the identity, qualifications, and skill levels of your workers are not as claimed, it could invalidate your insurance.

- It could adversely impact your health & safety and safeguarding obligations.

- If workers are abruptly removed from your business, it could lead to significant interruption to your operations and output.

- Your business could suffer reputational damage by association if illegal migrants are found to be involved in your business.

To be confident that supplied workers are above board, it is important to confirm with your contractors that they conduct the correct right-to-work checks on people they employ.

How to reduce your risk of hiring illegal migrants

The existing right-to-work checks for businesses will remain unchanged, including via a manual check of original documentation and a Home Office online checking system.

Manual check

You must check that:

- the documents are genuine, original and unchanged and belong to the person who has given them to you

- photos are the same across all documents and look like the applicant

- dates of birth are the same across all documents

- if two documents give different names, the applicant has supporting documents showing why the names differ, such as a marriage certificate or divorce decree.

If the applicant is not a British or Irish citizen, you must also check that:

- the dates for the applicant’s right to work in the UK have not expired

- the applicant has permission to do the type of work you are offering (including any limit on the number of hours they can work)

- for students you see evidence of their study and vacation times.

Home Office online check

The Home Office online checking system process takes around five minutes.

- If an applicant has given you their share code, you can check their right to work in the UK online.

- If no share code is provided, you can check if their documents allow them to work in the UK.

Additional resources:

- Employer’s guide to right to work checks

- Right to work checklist

- Avoiding discrimination while preventing illegal working

To find out more or speak to our construction team about any element of your risk management, please get in touch.