When significant, catastrophic storms like hurricanes Helene and Milton first hit, the first priority is always the impact on lives and livelihoods. But as the direct effects recede and communities begin to rebuild, it is worth reflecting on the impact to the insurance markets – as that, too, reflects our collective resilience to such events.

The good news is that despite their potential severity, these storms are unlikely to threaten any (re)insurers’ solvency. Of course there will be some notable losses; Milton in particular could trigger material reimbursements under the Florida Hurricane Catastrophe Fund, a state-run reinsurance facility. There are also likely to be pockets of significant losses arising from Helene, such as among regional carriers in Georgia, North Carolina and South Carolina.

Still, reinsurers’ 2025 business plans largely remain intact, and continue to show signs of increased appetite for natural catastrophe exposures, especially where they have existing relationships with trusted cedants.

There are broader reasons to be cautiously optimistic, too. Strong reinsurer returns mean additional capital is present to support cedants, and that creates space for creative solutions even in more challenging parts of the risk and cat market. At Gallagher Re, this is one area where we will focus our attention in the months ahead.

We see no strong justification for dramatic shifts in either pricing or retentions at 1.1 but anticipate reinsurers will look to “hold the line” at the renewal. Overall, Gallagher Re is anticipating mid-single-digit increase in demand for reinsurance alongside a high-single-digit increase in supply. As a result, despite relatively strong forecasted Return on Equity (RoEs) after dividends and buybacks, industry capital is only marginally outpacing the demand for additional limit and overall is in relative equilibrium.

Longer-term challenges

It is worth putting 2024 hurricane losses into a broader financial context. North American property insurers have faced significant financial challenges in recent years.

A reinsurance market that moved further away from loss has meant primary carriers have borne much of the brunt of recent natural catastrophe losses and remain capital-constrained in many geographies. As an industry, homeowners’ insurers have collectively lost money underwriting policyholders for four consecutive years.

Since 2020, calendar year combined ratios have been above the crucial 100% level at which costs exceed income, as Figure 1 shows. However, at the half year 2024, Gallagher Re’s latest combined ratio for US Composite Personal Lines carriers has improved by 13 points to 91.9%, partly as rate increases and cost sharing mechanisms have caught up with loss trends. Any improvement in the bottom line is encouraging, but carriers will want to be sure this is sustainable.

Figure 1: Combined ratios have been challenged in recent years

Calendar year combined ratios and changes in net written premiums for US homeowners’ insurers

Several challenges to profitability remain. Social and economic inflation continues to be a threat. alongside the elevated weather trends. As of the half-year point, elevated nat cat losses in Q2 pushed the H1 24 nat cat impact marginally above the 10-year average. The driver was another year of higher “secondary perils”, particularly for US severe convective storms – this time in Texas, Missouri and across the South in general. And of course, the full financial impact upon insurers of Helene in September, and Milton in October, remains to be seen.

Currently, US insured losses from natural catastrophes in 2024 are preliminarily estimated around the USD100 billion mark; equivalent to about 9.2% of the industry’s surplus capital. Yet for the ten years leading up to 2022, cat losses ran at about 7% of capital a year. In other words, as a proportion of surplus, cat losses are up by almost 30% in the past two years, while US policyholder surplus over this same time has only grown 18%.

These challenges have caused some carriers to exit personal lines entirely, or to do so in some US states. In addition, there was a significant jump in ratings downgrades of P&C carriers in 2023.

Meanwhile, we have also gone through a hardened market for property reinsurance from 2022 up to 2024. Higher reinsurance costs are not providing any relief to US P&C property writers, but there are now signs this could be stabilizing.

Reinsurers are in a good financial position

Overall, total dedicated reinsurance capital has returned to levels witnessed at the peak in 2021. This has been supported by near-record returns for reinsurers in 2023 and further strong results through H1 2024. There is a general acknowledgement amongst reinsurance markets that after two years of material increases, property rates are now adequate to sustain long-term profitability.

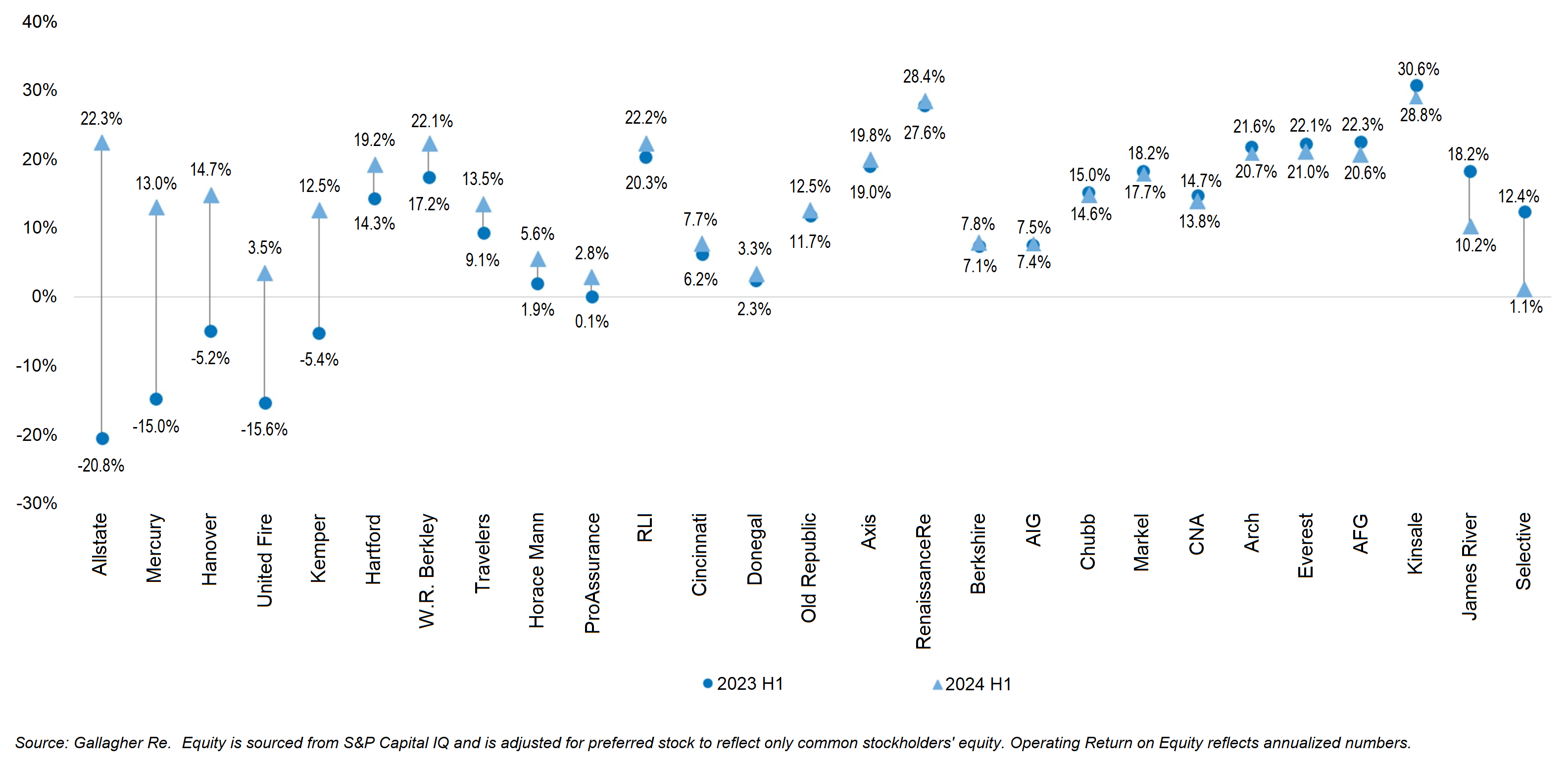

Property reinsurers, together with Excess and Surplus specialists, are delivering strong – and consistent – returns on equity. We can see this from the chart below, where several are gathered mainly on the right-hand side. While some of the personal and commercial carriers on the left have moved into positive RoE territory in 2024, in most cases they still sit below the level where reinsurers like Renaissance, Arch and Everest have stayed for the past 12 months. Driven by increased retained losses, primary carriers must address the increased volatility of their books.

Figure 2: North American (re)insurers’ financials show a mixed picture

Operating Return on Equity – 2024 H1 vs. 2023 H1

Because the vast majority of the H1 24 weather losses have been retained by primary companies, carriers must remain vigilant to aggregations and price adequacy of retained weather risk, while they wait for rate and cost sharing mechanisms to flow through the system and hope for more stability in their claims and reinsurance costs.

As we noted above, business conditions for primary carriers have not been easy. That said, we may be reaching an inflection point.

Capital and capacity: is the tide turning?

By 1.7 this year, the reinsurance quotes received by Gallagher Re demonstrated reinsurers’ attempts to hold on to gains achieved over the past couple of renewal cycles, but the market has appeared somewhat bifurcated. For peak peril buyers in markets like Florida, prices came down and capacity increased; but for regional carriers with exposures to SCS and wildfires, we are not seeing the same green shoots.

Gallagher Re actively focused on this part of the market, helping to mitigate some of this rate pressure through our dedicated cat facilities. Client differentiation is key, with cedants perceived by the market to be best-in-class on modeling and underwriting, able to secure materially better terms.

Nonetheless, some insurers have continued difficulties down low in their reinsurance cat towers, combined with a lack of a strong multiline market. In order to compensate, most companies are raising policyholder deductibles and prices in the primary market in a major way.

In some states, and for some products, the market will bear it. However, inevitably, some companies will suffer adverse selection – better (lower-risk) policyholders move in search of cheaper premiums, and the weaker ones remain because they have no choice.

With premium rate increases and underwriting actions, moving too fast and moving too slow can be equally unwise. Without thoughtful and deliberate approach to challenges such as portfolio optimization and price segmentation, companies risk years of underperformance in an otherwise potentially robust market. It takes time for rate and policyholder “sorting” to stabilize.

And of course, when it comes to the reinsurance markets, counsel from sophisticated risk advisors such as Gallagher Re can provide the expertise needed to differentiate risk selection, pricing, and aggregation management, all while building and maintaining robust reinsurance towers and relationships.