Few members probably see the connection between their finances and climate change. As the new requirement for pension schemes over a certain size to publish a Taskforce on Climate-related Financial Disclosures (TCFD) report comes into force, is there an opportunity to change this? Our pensions communications specialists share a few tips to communicate Environmental, Social and Governance (ESG) matters in an effective way.

With the recent heatwaves across Europe, climate change is at the forefront of everyone's mind. According to the ONS, 75% of adults in Great Britain worry about climate change. The UK Government is also introducing measures to encourage businesses to recognize and address their impact on our planet. Its work on this extends to pension schemes; the Government has stated that UK occupational pension schemes, with ~£2 trillion in combined assets, are "uniquely placed to invest in the financial opportunities that are emerging […] to drive us towards a lower carbon economy."

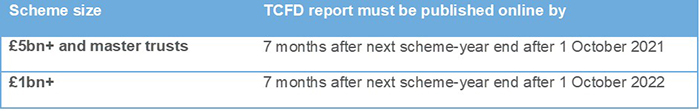

As a result, there's a new requirement for pension schemes over a certain size to publish a Taskforce on Climate-related Financial Disclosures (TCFD) report.

Currently, only large schemes are required to publish a report. But even if your scheme doesn't have to, it's worthwhile communicating with your members about ESG matters. Your Trustees' and investment managers' work in this space will be of interest to your members, who might feel reassured to know that their money is doing good.

What is a TCFD report?

The TCFD report is a public-facing document which must disclose what trustees are doing to understand and address the risks and opportunities that climate change can pose to their scheme. It must be made available on a public website. More detail about the report's required contents and structure is available on the TCFD website.

The Government is expected to review the position for smaller schemes in 2023.