Partnership. Expertise. Commitment.

Our industry experts provide insurance coverage, services and solutions tailored to meet your specific needs.

The interconnected nature of global trade means a major event in one region can create significant disruption globally. We've seen this play out repeatedly, with marine accidents, natural catastrophes and intra-regional conflict creating chokepoints that have caused vessels to back up, disrupting supply chains and ultimately inflating the cost of goods and components.

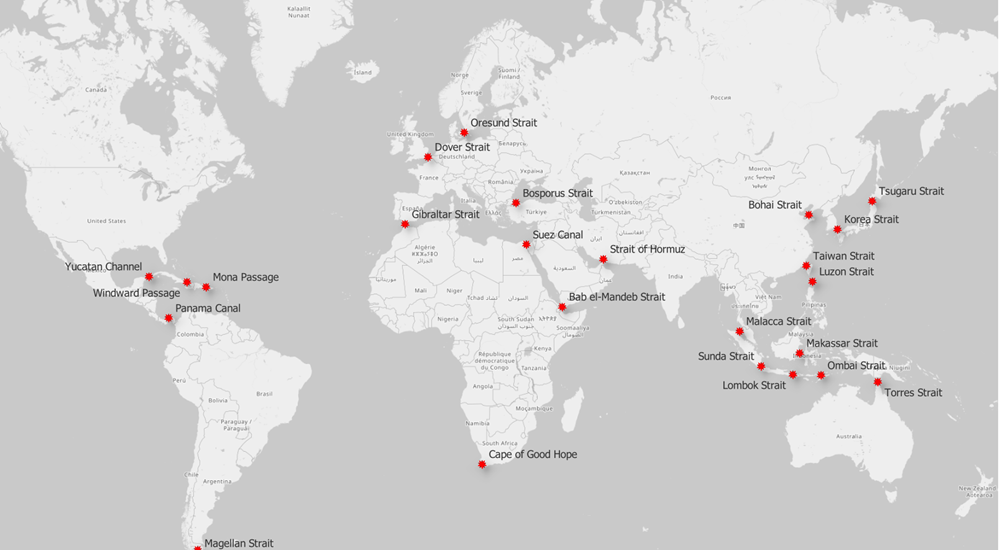

Some of the biggest supply chain disruptions in recent years have involved critical chokepoints, such as the grounding of the Ever Given in the Suez Canal in 2021 and port lockdowns during the pandemic.

More recently, port strikes have been in the news again, while the Panama Canal's susceptibility to drought has seen delays to the flow of goods between the Pacific and Atlantic Oceans. But geopolitical factors are having the greatest impact on marine trade in 2024.

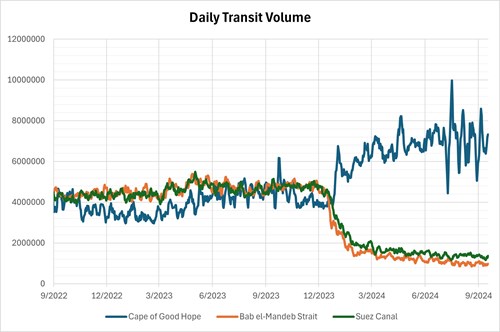

At its usual capacity, the Red Sea handles up to 20% of global container traffic,1 but attacks in the Red Sea by the Houthi group in Yemen have declined significantly. Vessels that would normally transit through the Suez Canal are bypassing the region and taking a much longer route around the Cape of Good Hope.

Since the start of the war in Israel and Gaza, the Houthis have been actively targeting cargo vessels and tankers passing through the Red Sea, causing losses in one of the world's most important waterways.2 Despite efforts to control the attacks, a growing number of shipping firms are opting to divert vessels.

Data from IMF PortWatch, which tracks the 7-day moving average for the Bab El Mandeb Strait, Cape of Good Hope, and the Suez Canal, demonstrates the pronounced shift that has taken place in maritime trading routes over the past two years.4

Jake Hernandez, chief executive of AnotherDay, a Gallagher company, said the tactics Houthis deployed in the Red Sea and impact on marine traffic is a case study in how quickly the world is changing.

Speaking at the Gallagher Future of Cargo Summit in September 2024, he told delegates. "The Houthis are a relatively basic organization, but they have been able to take technology, such as Iranian-provided ballistic anti-ship missiles, and use it in ways which affects global geopolitics."

"Conflicts are erupting where there is an overlap of interests," said Hernandez. "Iran has spent 20-30 years preparing to close the Strait of Hormuz to put pressure on the international order. These are some of the tactics that the Houthis have been using to flood the Strait with anti-ship missiles."

Rerouting via the southern tip of Africa can reduce exposure to intra-regional conflict, but it also changes the dynamic nature of supply chains.

Longer journey times mean greater uncertainty, higher fuel costs and the potential for bottlenecks and vessel bunching in African ports that may not be equipped for the uptick in volume.5 According to shipping giant Maersk, having more vessels tied up on extended voyages is leading to capacity shortages elsewhere.6

Moreover, journeying around the African continent increases the exposure to a range of physical and human-caused risks, such as tropical cyclones arising in the Western Indian Ocean and piracy.

While the pandemic-era congestion has diminished, the volatility of fluctuations is still present in Global Supply Chain Pressure Index data,7 reflecting ongoing challenges. Sharp increases in 2024 reflect production bottlenecks, transportation issues and geopolitical events.

Supply chains are only as strong as their weakest links, and companies will need to continue to account for worst-case scenarios in robust contingency planning.

Diversifying and shortening supply chains, near-shoring/onshoring and stockpiling can help de-risk supply chains and reduce the impact of marine bottlenecks, while investing in data and analytics can help businesses better anticipate and respond to disruption.

A research collaboration between Gallagher Research Centre and the Environmental Change Institute 's (ECI's) Oxford Programme for Sustainable Infrastructure Systems (OPSIS) is underway to help (re)insurers understand critical chokepoints in the global supply chain.8

Oxford's research has identified 24 maritime regions of the world where an estimated $190 billion a year of global trade is at risk. The research identifies different causes of chokepoints and their risk to trade. Causes include armed conflict, terrorist attacks, cyclones, drought, accidents, interstate conflict and piracy.

It will help to more accurately model how sources of disruption ripple through supply chains.

Nick Croxford, head of Marine and Energy at Gallagher Re said: "The maritime insurance industry faces a myriad of challenges today, including environmental risks, cyber threats, geopolitical uncertainties and supply chain disruption. Getting under the bonnet and exploring both the challenges and potential solutions on the horizon is crucial to the industry."

Published November 2024

1Clapp, Sebastian. "Maritime Security: Situation in the Red Sea and EU Response," European Parliamentary Research Service, Mar 2024. PDF file.

2Boorstein, Aaron. "Cargo Ships Keep Getting Bigger, and Infrastructure Is Racing to Keep Up," Smithsonian Magazine, 28 Mar 2024.

3Scarr, Simon, et al. "Red Sea Attacks," Reuters, 2 Feb 2024.

4Camberg, Katherine. "The Increasing Risks of Black Sea Shipping," AEI, 6 Nov 2023.

5"Monitoring Trade Disruptions from Space," IMF PortWatch, accessed 30 Oct 2024.

6Hoffman, Helene. "The Ongoing Ripple Effects of Red Sea Shipping Disruptions," Maersk, 9 Jul 2024.

7"Global Supply Chain Pressure Index (GSCPI)," Federal Reserve Bank of New York, accessed 30 Oct 2024.

8Hall, Jim. "Gallagher Re and ECI to Model Marine Chokepoints in Global Supply Chain," Environmental Change Institute, 14 May 2024.