Understanding tax bracket creep can help you make more informed financial decisions when it comes to income/salary considerations, optimising your tax effectiveness and planning your retirement. It can also help you confidently engage in discussions about tax policies.

To understand bracket creep, you first need to understand Australia's progressive tax system and average tax rates. In this article, we will discuss these factors and provide an overview of the stage 3 tax cuts (effective from 1 July 2024) and its impact.

What is a progressive tax system?

The Australian income tax system is "progressive," meaning that the more an individual earns, the more they pay in income tax. In this system, higher-income individuals are subject to higher tax rates, while lower-income individuals are subject to lower tax rates according to the tax thresholds.

The Australian residents tax rates for 2024-25 looks like the below. The table shows the thresholds in which tax rates increase with taxable income.

| Taxable income | Tax rate |

| 0 — $18,200 | Tax free |

| $18,201 — $45,000 | 16% |

| $45,001 — $135,000 | 30% |

| $135,001 — $190,000 | 37% |

| $190,001 and over | 45% |

The above rates do not include the Medicare levy of 2%.

Using the 2024-25 tax rates as an example, a lower earning individual making $18,200 would not have to pay tax on this income as it is within the 'tax-free threshold'. A higher-income individual would be subject to a higher tax rate — their next $26,800 is taxed at 16%, the following $90,000 at 30% etc.

What is the difference between marginal vs average tax rate?

Another important concept to understanding bracket creep is marginal vs average tax rates.

The marginal tax rate is the amount of tax an individual pays on additional income they earn according to the tax brackets. In the above example, it's the 16% (from $18,201 to $45,000).

An average tax rate on the other hand, is the total tax as a proportion of an individual's total taxable income.

As an example, consider an individual with an income of $150,000.

- They would pay no tax on their first $18,200

- 16% on their next $26,800

- 30% on their next $90,000

- 37% on their last $15,000

This results in a total tax of just over $36,800. $36,800 as a proportion of total income is around 24.6% - this percentage is the average tax rate.

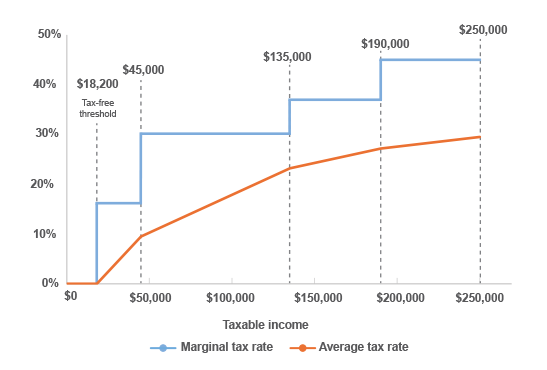

See below as a visual representation.

Comparison of marginal and average tax rates for 2024-25

Note: Excludes levies and offsets for illustrative purposes.

What is bracket creep and its impact?

Bracket creep occurs when rising incomes cause individuals to pay a higher average tax rate, even though there may not have been changes to marginal tax rates and thresholds.

The impact of this is felt during periods of high inflation, wherein salary growth means more paid in tax, but an individual's purchasing power is lower. This means that the value of this growth and a person's standard of living is not felt positively.

What is the government's role in bracket creep?

Bracket creep inevitably occurs as pay increases and can impact the standard of living of individual taxpayers. As Australia's tax rates and thresholds do not automatically adjust for inflation, changes must be legislated to manage average tax rates.

Having a clear understanding of bracket creep will help you assess how tax brackets affect your financial situation, empowering you to make informed decisions with confidence.

How Gallagher can help

It's always a good time to review your tax-effective strategies and make the most of any changes to your financial situation. So, wherever you are on your financial journey, we can help you plan for the future tax-effectively. Our advisers can help you achieve your financial goals by bridging the gap of where you are today and where you want to be tomorrow. Get in touch today.