Partnership. Expertise. Commitment.

Our industry experts provide insurance coverage, services and solutions tailored to meet your specific needs.

With continued disruption from multiple and sometimes intersecting causes, the world is in a state of 'permacrisis', according to the 2023 Allianz Risk Barometer which canvasses businesses and risk management experts to identify key concerns for the coming year. The findings represent views from 2,712 respondents from 94 countries and territories, including Australia.

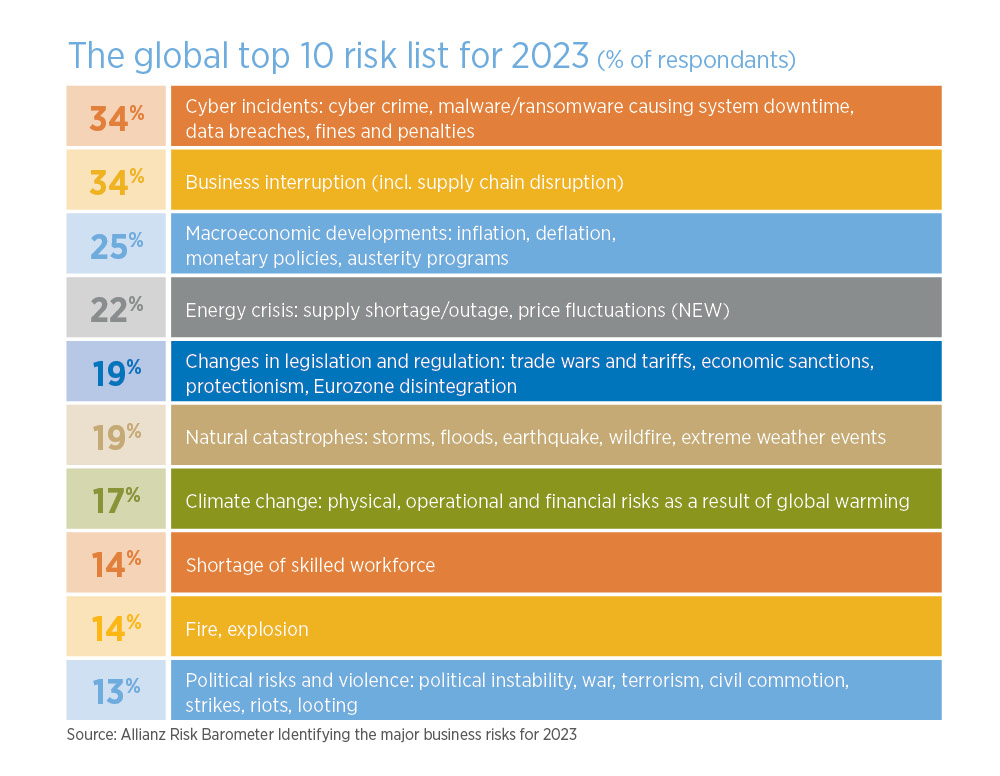

The report warns that elevated levels of disruption look set to continue and that businesses will need to take systematic precautions to strengthen their economic and physical resilience. While mounting cyber breaches and business interruption top the risk list for businesses globally, the unexpected geopolitical crises and macroeconomic challenges of the last year have pushed threats such as inflation and the energy crisis into the top five.

In Australia, not surprisingly given the extreme weather and climate events of the past few years, natural catastrophes have risen to first place on the risk list, driven by events such as flooding, which resulted in the country's costliest ever national catastrophe in 2022. The related risks of business interruption and climate change share second position.

The key business risk factors testing already strained business models and supply chains include:

Despite positive moves to diversify business models and supply chains since COVID-19, businesses continue to face significant challenges. The pandemic delivered a massive shock to business models, creating global shortages, delays and higher prices, while the war in Ukraine triggered an energy crisis, particularly in Europe, turbocharging inflation.

Alongside disruptions caused by the pandemic incidence of cyber crime surged exponentially. The ongoing concern about cyber risks reflects the importance of today's digital economy and the evolving threat from ransomware and extortion, as well as geopolitical rivalries and conflicts increasingly being played out in cyber space.

Cyber risk and business interruption are closely linked, with cyber also ranking as the business interruption cause that businesses fear most. Survey results show that a number of business interruption-related risks have climbed this year's rankings as the new economic and political conditions continue to affect business operations. These include the impact of the energy crisis (4th highest rated risk) and macroeconomic developments, such as inflation and potential recession (3rd — its highest position since the first Risk Barometer in 2012).

Political risks and violence is another new entry in the top 10 global risks, shortage of skilled workforce has become more of a concern and the prospect of critical infrastructure blackouts or failures is more top of mind for respondents than 12 months ago.

Conversely worry about pandemic outbreaks has dropped nine places as lockdowns and restrictions have eased in most major markets. China is the exception as businesses face pandemic impacts as restrictions have been lifted.

Businesses are reacting to current conditions and perceived risks by diversifying their business and supply chains in numbers as well as geographical locations, and intensifying scrutiny on selection, monitoring, auditing and risk assessments. Contractual agreements with suppliers also need to provide security.

Businesses are also seeking to make their business models more flexible and adaptable to risks, with shorter business production cycles likely to be adopted by some businesses. Another positive development is sharper focus on continuity planning — the second most common de-risking action taken by survey respondents.

Finally, transparency and quality of data are critical to effective risk management, reporting and planning to avoid supply disruption and consequent interruption.

Our Gallagher business insurance specialists can advise on risk identification and provide guidance on management strategies, as well as alerting you to any gap exposures that may have been overlooked and proposing insurance and risk solutions.

Gallagher provides insurance, risk management and benefits consulting services for clients in response to both known and unknown risk exposures. When providing analysis and recommendations regarding potential insurance coverage, potential claims and/or operational strategy in response to national emergencies (including health crises), we do so from an insurance and/or risk management perspective, and offer broad information about risk mitigation, loss control strategy and potential claim exposures. We have prepared this commentary and other news alerts for general information purposes only and the material is not intended to be, nor should it be interpreted as, legal or client-specific risk management advice. General insurance descriptions contained herein do not include complete insurance policy definitions, terms and/or conditions, and should not be relied on for coverage interpretation. The information may not include current governmental or insurance developments, is provided without knowledge of the individual recipient's industry or specific business or coverage circumstances, and in no way reflects or promises to provide insurance coverage outcomes that only insurance carriers' control.

Gallagher publications may contain links to non-Gallagher websites that are created and controlled by other organisations. We claim no responsibility for the content of any linked website, or any link contained therein. The inclusion of any link does not imply endorsement by Gallagher, as we have no responsibility for information referenced in material owned and controlled by other parties. Gallagher strongly encourages you to review any separate terms of use and privacy policies governing use of these third party websites and resources.

Insurance brokerage and related services to be provided by Arthur J. Gallagher & Co (Aus) Limited (ABN 34 005 543 920). Australian Financial Services License (AFSL) No. 238312