Partnership. Expertise. Commitment.

Our industry experts provide insurance coverage, services and solutions tailored to meet your specific needs.

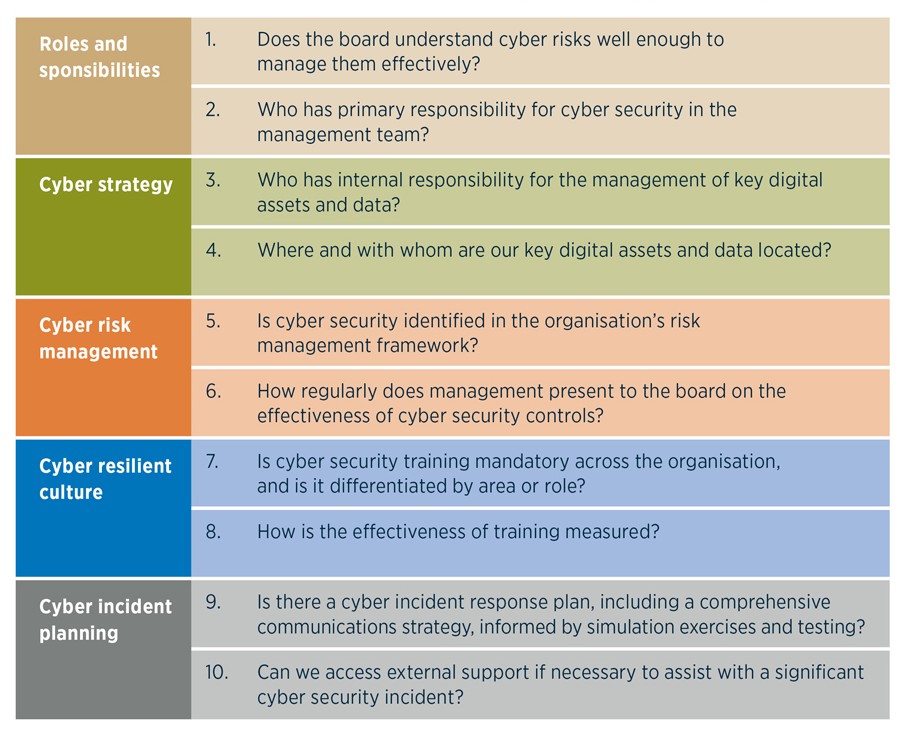

Cyber risk management at a board and director level is not only a top-of mind concern but also a duty of responsibility and potential liability. To support the accountability of directors for cyber security and diligence, a guide, Cyber Security Governance Principles, has been established to provide a framework for directors to fulfil their duties and obligations in governing and building an organisations cyber resilience.

The Cyber Security Governance Principles have been developed through a partnership between the Australian Institute of Company Directors (AICD) and the Cyber Security Cooperative Research Centre (CSCRC) in consultation with senior directors, experts in cyber security, regulators and government agencies, and are designed to prompt directors to:

The starting point for boards is to set the agenda for promoting a cyber resilience culture from a top down senior management position.

Defining clear roles and responsibilities is fundamental to building effective cyber resilience.

Comprehensive and clear board reporting is critical to boards being able to assess the resilience of their organisation and should include engagement with management and updates on emerging trends.

External experts can play a role in providing advice to directors and identifying areas for improvement.

Watch outs: red flags

Proactively overseen by the board, a cyber strategy can enable a business to identify opportunities to build cyber resilience.

Identifying the key digital assets and data of an organisation, including who has access to these, is central to understanding and enhancing cyber security capability.

A robust cyber strategy should take into account the importance, and potential risks, associated with third party suppliers.

Watch outs: red flags

Cyber security is an operational risk within an organisation's existing approach to risk management.

While cyber risk cannot be completely eradicated, there are a number of accessible and low-cost controls that all organisations can use.

The board should regularly assess the effectiveness of cyber controls against changes in the threat environment, technology developments and the organisation's capabilities.

Watch outs: red flags

A business's board level cyber strategy provides a basis for building cyber resilience.

Regular, engaging and relevant training is key to promoting a cyber resilient culture and should include specific training for directors.

Incentivise and promote strong cyber security practices, including participation in phishing testing and penetration exercises.

Watch outs: red flags

Directors should proactively prepare and plan for a significant cyber incident to develop a formalised response plan.

Communications with all key stakeholders in a significant cyber incident is critical to mitigating reputational damage and enabling an effective recovery.

Simulation exercises and scenario testing are key tools for the board and senior management to understand roles and responsibilities, and in testing the cyber incident response plan.

Watch outs: red flags

Refer to the Cyber Security Governance Principles guide for detailed advice and considerations around these principles and to leverage this framework to establish best practice management of cyber security governance for boards and directors.

In the event of a cyber attack a robust cyber insurance policy provides access to experts not only in negotiation but also forensic investigation, remediation measures, as well as cover for the legal and reputational costs involved.

Gallagher cyber insurance and risk specialists provide support to businesses of all sizes and industries in facing cyber risks. In addition to cyber insurance protection Gallagher offers expertise, advice and resources for building business resilience to withstand cyber security incidents.

Gallagher provides insurance, risk management and benefits consulting services for clients in response to both known and unknown risk exposures. When providing analysis and recommendations regarding potential insurance coverage, potential claims and/or operational strategy in response to national emergencies (including health crises), we do so from an insurance and/or risk management perspective, and offer broad information about risk mitigation, loss control strategy and potential claim exposures. We have prepared this commentary and other news alerts for general information purposes only and the material is not intended to be, nor should it be interpreted as, legal or client-specific risk management advice. General insurance descriptions contained herein do not include complete insurance policy definitions, terms and/or conditions, and should not be relied on for coverage interpretation. The information may not include current governmental or insurance developments, is provided without knowledge of the individual recipient's industry or specific business or coverage circumstances, and in no way reflects or promises to provide insurance coverage outcomes that only insurance carriers' control.

Gallagher publications may contain links to non-Gallagher websites that are created and controlled by other organisations. We claim no responsibility for the content of any linked website, or any link contained therein. The inclusion of any link does not imply endorsement by Gallagher, as we have no responsibility for information referenced in material owned and controlled by other parties. Gallagher strongly encourages you to review any separate terms of use and privacy policies governing use of these third party websites and resources.

Insurance brokerage and related services to be provided by Arthur J. Gallagher & Co (Aus) Limited (ABN 34 005 543 920). Australian Financial Services License (AFSL) No. 238312